The Penny is Gone: What Businesses Need to Know

By: Brent Patterson

Director of Product Management, CPI

“The penny has been talked about being removed for quite some time due to the high cost of producing the penny. It’s almost four times the cost of a penny to actually produce a single penny.”

With the recent legislation signed earlier this year, the U.S. has officially stopped minting new pennies. “The federal government is no longer supplying new pennies into the economy. So they’re not making more. They’re not distributing more to banks.”

This rapid change has created challenges for retailers and financial institutions. “Retailers… are experiencing shortages of pennies. And as a result, they’re not able to give exact change in cash transactions down to the penny.”

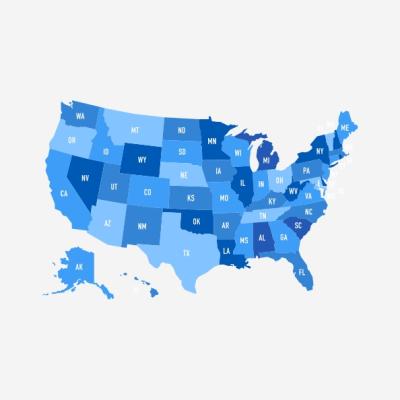

The solution? Rounding. “We simply no longer have a penny to be able to pay out. We have to round essentially to the next highest nickel or lowest nickel.” But it’s not that simple. “Many states have laws in place that do not allow rounding down to the nearest nickel. It’s actually illegal to do that in at least ten states.”

To address this, Congress is considering the Common Sense Act. “Its very job is to enact a federal law that allows rounding in cash transactions… When that is passed, that will supersede all the state laws and allow one common approach for all retailers.”

How CPI Is Helping Businesses Navigate the Change

At CPI, we understand that this transition isn’t just about coins, it’s about keeping your operations running smoothly. Brent explains:

“Our products are relatively robust and are able to support this… most of our coin products just need a minor configuration change.”

That means CPI customers can adapt quickly without costly hardware replacements. “It’s DIY, so it’s easily configurable in the field. And overall most of our solutions will be able to be supported DIY.” For larger organizations, CPI’s service team is ready: “Service team is capable, obviously, to handle these type of situations and as well skilled and trained to be able to support.”

Looking ahead, CPI is already designing for a penniless future. “Removal of the penny allows us to add in more nickels, more dimes, more quarters, and have longer fill periods… ultimately a win for our customers.” Longer refill cycles mean less downtime, lower labor costs, and improved efficiency.

As Brent sums it up: “Until the law is updated universally, we have to be prepared to support the acceptance of pennies as well as the rejection of pennies… based upon legal statutes that are required to be changed.

CPI is committed to being your trusted partner through this transition. From technical briefs and configuration guides to hands-on support, we’re here to ensure your business stays compliant, efficient, and ready for what’s next.

Meet the Author:

When it comes to navigating major shifts in currency and payment systems, few voices carry as much weight as Brent Patterson, Director of Product Management at CPI. Brent has spent years shaping the technology behind cash handling solutions, making him a trusted authority on how changes like the elimination of the penny ripple through retail operations and consumer experiences.