What Does the Future of the Wallet Look Like?

Fast forward to 2030: what does the wallet look like, and have all consumers adopted digital payment technologies? While the cashless economy debate continues, businesses worldwide are racing to keep up with rapid changes in both technology and consumer expectations. We’ve swapped swiping credit cards for tapping smartphones, and checks? Those were written off long ago. Add in busy lifestyles, conflicting demands and endless distractions, and it’s clear that our culture of convenience has catalyzed a paradigm shift in payment preferences that’s evolving faster than you can say swipe.

How are future-proof businesses staying ahead of the ever-changing global payments landscape?

"By accepting mobile payments like Apple Pay, Google Pay and Samsung Pay, businesses not only create better customer experiences, increase efficiency and save money—they meet consumers’ growing demand to pay using whatever method they like, wherever they are."

No Cash? No Problem.

With roughly 76 percent of Americans carrying less than $50 in cash in their wallets on a regular basis, it’s no surprise that cashless technology is on the rise. From self-service kiosks to transportation, consumers expect flexible payment solutions that make completing a transaction as easy as sending a text. And smart payments are not only making things easier on consumers—businesses are profiting, too. For example, vending machines equipped with cashless readers benefit from a 25 percent increase in sales.

As cashless commerce continues to rise, modern merchants are looking beyond swipe-only card readers to increase security, efficiency and convenience. While tap and EMV chip technologies are still catching on worldwide, in countries like the U.K., contactless payments are quickly becoming the norm. In fact, one in 10 adults in the U.K. have gone cashless—with that figure rising to more than one in six among those ages 25-34.

To meet evolving payment expectations, merchants across markets are turning to all-in-one card readers that accept any ePayment technology. By accepting mobile payments like Apple Pay, Google Pay and Samsung Pay, businesses not only create better customer experiences, increase efficiency and save money—they meet consumers’ growing demand to pay using whatever method they like, wherever they are. Integrating mobile payment technology also opens up a world of opportunity to increase sales by allowing consumers who have left their wallets at home to make purchases using only their phones.

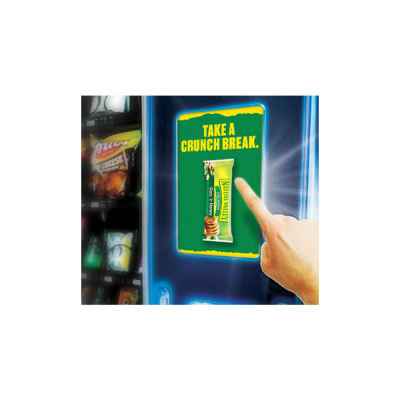

"Investing in innovative card reader technology also allows businesses to reach customers directly through branded, customizable content delivered at the Point of Sale"

Engaging Your Customers Beyond Payment

It’s not just flexibility and convenience driving people to reach for their digital wallets. As research from Bridge2 Solutions and CAPCO indicates, two-thirds of consumers surveyed said they want loyalty features in their mobile payments and 94 percent said they would use a mobile wallet more frequently if they could earn and redeem loyalty points with every transaction. This makes loyalty program integration key to enticing customers, particularly Millennials and younger demographics.

In the race to enhance customer experiences while offering incentives for buyers to purchase more, financial institutions are also turning to loyalty program integration. For example, American Express encourages corporate cardholders to pay with their smartphones as part of their partnership with Apple Pay, adding to the growing list of companies that are seizing the opportunity to add value to customers through personalized deals and offers.

Investing in innovative card reader technology also allows businesses to reach customers directly through branded, customizable content delivered at the Point of Sale (POS). Full color displays, graphics and digital advertising are making transaction experiences more personalized and engaging—which directly translate to sales.

"By adopting a broader range of ePayment technologies, merchants will miss fewer sales...and meet rising demands for convenience and flexibility."

Don't Stop at Cash: Complete Your Payment Ecosystem

While cash remains the world’s most widely used payment method, businesses must revisit their POS systems and the increasingly vital role of smart solutions to provide a more complete payment experience. As cashless technologies continue to advance, investments should be made carefully and comprehensively. By adopting a broader range of payment technologies, merchants will miss fewer sales, gain deeper insights into unattended payments and meet rising demands for convenience and flexibility.

The rules of money are changing. Is your business equipped with a payment strategy that meets the diverse needs of every customer?