Retail Readiness Starts Now: A Practical Plan for the Catalyst Currency Refresh

By Chad Pinson, Director of Sales - Retail

If you work in retail, you already understand a hard truth: fraud doesn’t go away. You manage it with strong operations, the right technology, and a well‑trained team. The upcoming U.S. currency redesign, formally known as the Catalyst Series, is going to test all three.

This isn’t a simple cosmetic update.

It represents a major shift in how currency interacts with retail technology, and it will require ongoing work over the next eight years.

I spend most of my time working with retailers who run high‑volume front ends utilizing large self‑checkout deployments and relying on back office product lines like table top cash counters and smart safes. Across the industry, the message is consistent: with the right plan, retailers can stay ahead of the transition and avoid the operational pain that comes from being unprepared. What follows is the practical guidance I shared during our recent webinar: what you need to do now, what to expect, and how CPI can support you through the changes ahead.

Why this redesign matters

Counterfeit activity always rises during a currency transition. Criminals look for environments where they can exploit speed, distraction, and pressure. That describes the modern retail checkout perfectly. During the rollout of a new note, customers and associates are still learning how to recognize new features, which increases the chance of counterfeit bills slipping through. As I mentioned in the webinar: fraud doesn’t disappear; it gets managed. And in this case, you’ll manage it with technology that’s ready on day one.

This change affects every device in your business that authenticates or accepts cash. That includes self‑checkouts, attended lanes with validators or recyclers, smart safes, back‑office currency counters, kiosks, and any other systems where cash enters your environment. Because the government is releasing denominations on a staggered schedule, this becomes a long‑term operational discipline rather than a one‑off project.

Where to start?

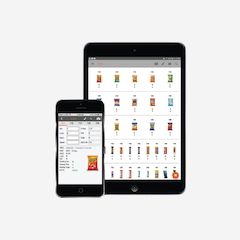

The first step is to understand your entire device footprint. Every retailer, regardless of size and complexity, needs to have a complete inventory of every cash‑handling device. For each device, collect the model information, serial number, firmware version, connection type, service status, and whether it’s approaching end of life. This single exercise creates the foundation for your entire readiness plan. It tells you which devices can be updated remotely, which ones need a technician on‑site, and which ones may not be worth updating at all because they are due for replacement.

Focus on the devices that matter most

Once you know what you have, the next step is prioritization. Not all devices pose the same operational risk, and not all stores need to be addressed at the same time. As an example, start with the customer‑facing devices that drive the bulk of your cash acceptance which would typically be the self‑checkout lanes and the highest‑volume front‑end registers. Next, consider the stores that handle the most cash or have a history of higher shrink. Then consider the age and condition of the hardware itself. In many cases, the smartest path forward is focusing on the devices that can receive remote updates first, followed by manual updates later.

This sequencing matters. Without it, stores can get overwhelmed, updates can stall, and it becomes difficult to avoid peak‑season disruptions. A thoughtful sequence prevents those challenges and creates a smoother experience for store operators.

Build a practical, phased upgrade plan

The Catalyst rollout lasts years, which means your plan needs to be realistic and paced. Many retailers begin with equipment that can be updated over the air because it’s the fastest way to make progress and reduces the amount of labor required in stores. After that, you can move to the back‑office counters and smart safes that require manual or on‑site updating. From there, you can schedule work based on operational windows, avoiding periods like holidays, inventory preparation, or major promotional events.

Because new denominations will continue to roll out over time (and because counterfeiters adapt) you should expect additional updates each year. Treat this as an annual operational process, similar to PCI updates or seasonal preparedness cycles.

Prepare your associates—not just your devices

Even the best technology needs people behind it who understand what’s happening. Associates must be comfortable handling note rejections, explaining situations to customers, and recognizing new security features. During the early months of any new note’s introduction, confidence matters. Quick‑reference materials at the checkout, brief refresher modules, and regular reinforcement from Loss Prevention all go a long way.

Training should be refreshed annually as each new denomination is introduced. This can’t be a one‑time education effort, instead make it part of operating effectively through an extended redesign cycle.

How CPI supports you through the transition

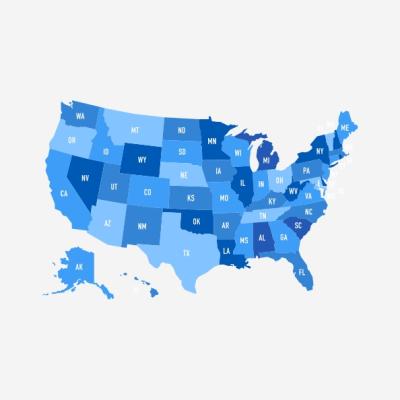

At CPI, we’ve been preparing for this for a long time. Our engineering teams, field technicians, and OEM partners are aligned to make sure retailers can move through the transition with minimal disruption. The goal would be to push remote updates but that’s not the case for all cash devices in question and when onsite work is required, we have more than 450 W‑2 technicians across the country to support your stores. We also work directly with self‑checkout and POS partners to ensure bill sets and firmware updates are properly integrated.

For those with limited bandwidth, or large complex organizations, we can manage the entire refresh cycle, from auditing and planning to execution and verification. Our goal is simple: make the currency refresh seamless, secure, efficient, and customer‑friendly.

Your next step begins with the Readiness Playbook

If you haven’t started planning yet, you’re not behind… but now is time to begin. Visit our CPI Resource Center and download the Retail Readiness Playbook. Inside, you’ll find audit tools, sequencing guidance, timelines, and practical next steps you can start using immediately with your Operations, IT, Loss Prevention, and Finance teams.

Your stores work best when your teams have clarity. Building your plan now ensures you’re ready when the first redesigned $10 note makes its appearance in your store later this year.