“How do I make machine ownership and management easier?” This is a question repeated by operators regardless of field base, level of experience, or level of investment in their vending business. As technology rapidly evolves in the vending space, and hardware becomes more complex, the days of simply filling a machine and walking away are quickly fading. When we talk about trends in the market, they revolve around two main principles: “Cash is dead,” and “Connectivity is the future.” What can we make of those two statements? That the future doesn’t include cash? That connectivity and cash can’t coexist, let alone work in tandem? At the 2019 NAMA Show in Las Vegas, Chuck Reed, VP/GM of Vending at CPI brought to the audience a different idea: what if you could add connectivity to your cash hardware for a simplified vending experience?

Read on for the recap of Chuck’s presentation, and gain insights as to how connected cash hardware will help reduce your service calls and enable your team for more efficient troubleshooting.

As CPI developed the next generation of note and coin hardware, research turned up the broad market trend that has become ever pervasive in the industry: cash is dead. But with cashless sales—although growing—at best making up only 40% of sales in a given machine, there is still the case to be made that the demand for the acceptance of cash isn’t going anywhere. Plus, with U.S. consumers preferring cash for purchases under $10 (at a rate of 65%), it seems evident that the payment type operators should be focused on is whatever is in the consumer’s pocket—be that credit cards, mobile payment, or cash.

Cash hardware gets a bad reputation in vending. When a machine is out of service, the first complaint placed by patrons is typically “It’s not taking my money.” Based on a 2015 case study, CPI found that while 80% of machine service calls are attributed to payment hardware issues, only 10% of these problems are actually caused by the payment system.

In juxtaposition, connectivity provided by cashless hardware has been viewed by the industry as revolutionary. By enabling that single connection to the machine, operators are given access to information that has transformed their business, be it route management insights, sales data, or DEX information.

The misconception comes with the idea that connectivity stops at cashless payment; that cash hardware is static and can do little more than accept dollars and give quarters in return. Knowing that cash hardware is often the first place to look when problems arise, what if we could equip that hardware to talk the same way a cashless device does? What if we could make your cash hardware smarter?

The idea is simple: Enable the devices to communicate independently of the VMC, and connect them wirelessly to a diagnostic tool so they can report their health status and relevant system data. What does that data look like? Picture this:

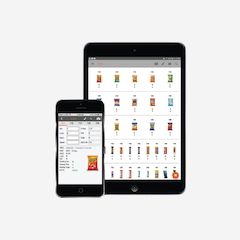

A route driver or technician approaches a bank of machines, and can instantly see, in simple green, yellow or red icons, the health status of every payment peripheral in those machines. They can see all alarms in priority sequence to help the tech work through the tasks at hand. And best of all, any alarm automatically links to a series of written troubleshooting steps or videos to walk anyone through to resolution.

By connecting cash hardware, diagnostic data is unlocked to help technicians quickly troubleshoot problems. By eliminating the diagnosis process, and letting a mobile app or tool perform the diagnosis for you, you eliminate on-site servicing time by nearly 25%. Moreover, because we know that most service calls are actually the result of problems incorrectly diagnosed the first time, if a driver or technician is equipped with a tool that can instantly and correctly diagnose the problem, they can fix the problem correctly the first time. This eliminates those follow up calls and visits.

A route driver, even with limited technical experience, can solve most problems if they simply had the right tools to teach them. In fact, this idea could expand to self-operating locations, enabling on-site personnel to do first-level triage before even calling you. In most cases, you can reduce the number of calls your experienced technicians need to make, prioritizing them for more difficult troubleshooting needs.

Whether via proactive alerts for each machine’s payment hardware, less time at the machine diagnosing and troubleshooting, fewer follow up service calls, or possibly even empowering the location to fix simple issues, connected cash hardware can increase machine uptime, and, in turn, increase your uptime for better sales. Connectivity isn’t just for cashless hardware anytime. The future is here, and cash is very much a part of that future.