As the U.S. Treasury phases out penny production, CPI is here to help you adapt with clarity, compliance, and operational readiness. Whether you're a retailer, financial institution, or industry partner, we’ve developed the tools, updates, and support you need to transition smoothly.

Understanding the Penny Phase Out

The U.S. Mint pressed its final penny in November 2025, ending more than 230 years of circulation.

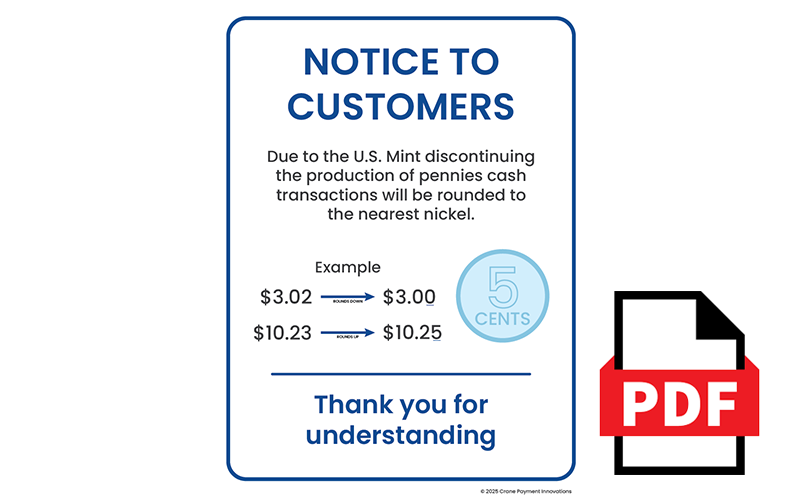

Why is this happening? Each penny costs nearly 4 cents to produce, creating an annual loss of $85 million for the Treasury. Ending production saves $56 million per year. Existing pennies remain legal tender, but shortages are already impacting businesses. Legislation under the proposed Common Cents Act will standardize rounding to the nearest nickel, but for now the laws are regional and inconsistent... leaving retailers and businesses to figure out how to adapt.

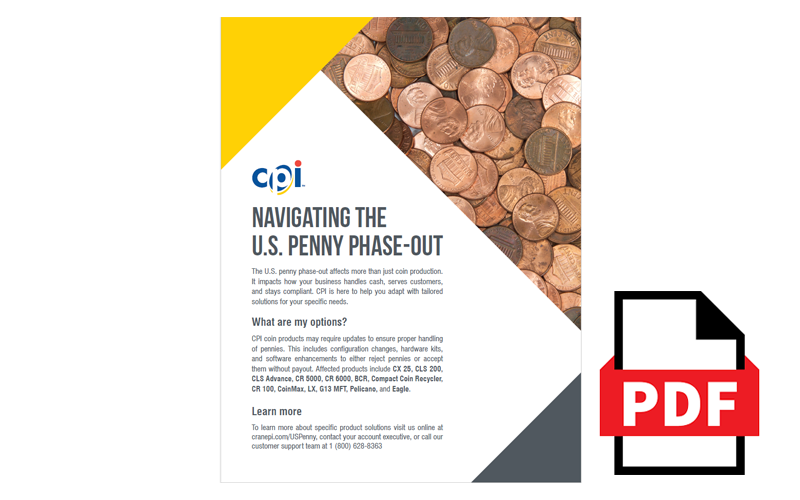

The U.S. penny phase-out affects more than just coin production. It impacts how your business handles cash, serves customers, and stays compliant.

What this means for you

Fast-food chains and supermarkets are rounding cash transactions to the nearest nickel. Some round down to avoid customer dissatisfaction, absorbing margin losses.

- Ensure smooth transactions with updated coin configurations

- Avoid payout errors and customer confusion at the point of sale

- Stay compliant with rounding rules and local regulations

CPI Resource Center

Download Technical Bulletins

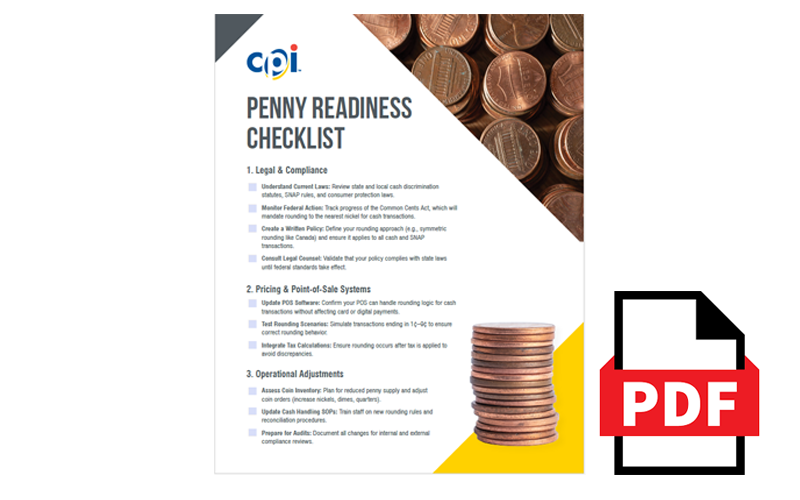

Our Technical Bulletins provide step-by-step guidance to help you prepare your coin-handling equipment for the U.S. penny phase-out. Organized by product, each bulletin outlines available options and detailed instructions for implementing necessary modifications—such as configuration changes, firmware updates, and operational adjustments. These resources ensure your devices remain compliant and efficient throughout the transition.

Other Resources

- Webinar: Beyond the Penny - Operational Readiness for Retail and Business

- CPI Thoughtcast: CPI's Director of Product Management sit down for a special episode of CPI's podcast series.

- Blog: What the Penny Elimination Means For Businesses

- Blog: Navigating Rounding Rules and Consumer Protection in a Post-Penny World